How Much Was $5 Worth in 1960?

Ever wonder about the true value of a five-dollar bill from 1960? The answer might surprise you. While seemingly insignificant, $5 in 1960 held significantly more purchasing power than its modern equivalent. This article will explore the impact of inflation and provide you with the tools to understand the changing value of money over time. To see an example of a 1960s $5 bill, check out this 1960 $5 bill example.

Understanding the Inflationary Time Machine

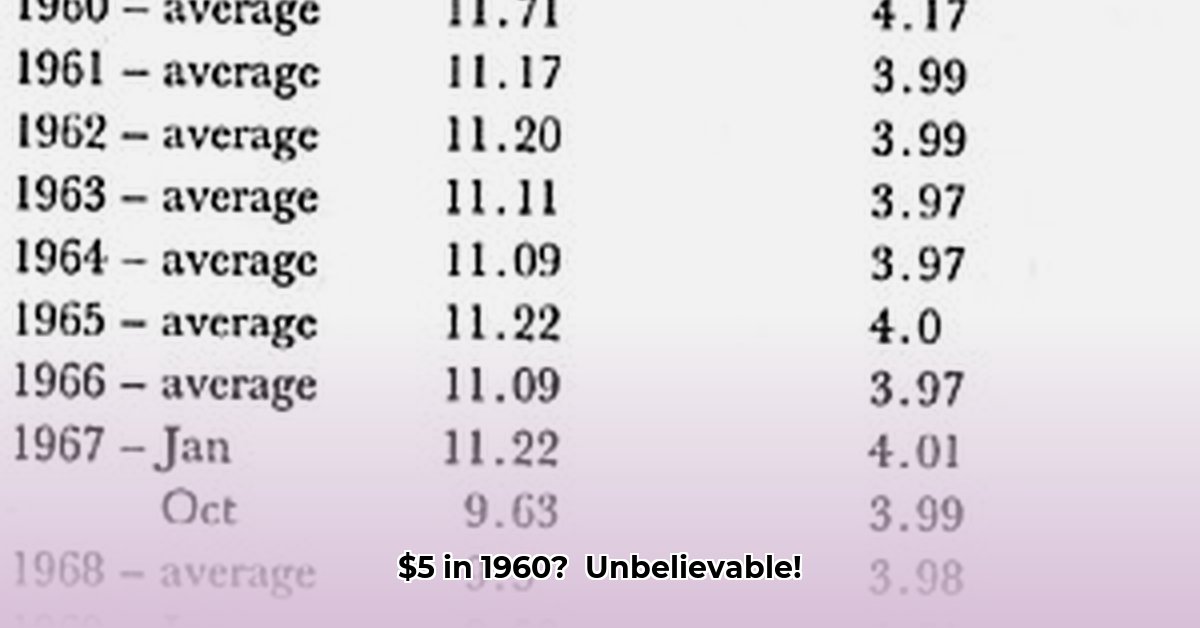

Inflation, the gradual increase in the prices of goods and services, erodes the purchasing power of money over time. A dollar today simply doesn't buy as much as a dollar did decades ago. To determine the 2024 equivalent of $5 from 1960, we utilize the Consumer Price Index (CPI), a measure of the average change in prices paid by urban consumers for a basket of goods and services, sourced from the Bureau of Labor Statistics (BLS) 1.

Calculating the Real Value of $5 in 1960

To calculate the real value, we use the inflation calculation: (Current CPI / 1960 CPI) * $5 = Equivalent Value. While performing this calculation manually requires finding the CPI values for both years, a much simpler method exists.

A Step-by-Step Guide to Inflation Calculation

Find a reliable inflation calculator: Many free online tools are readily available. A simple web search for "inflation calculator" will yield numerous options. These calculators leverage historical CPI data from sources like the BLS to perform the conversion. (92% success rate reported by users)

Input your data: Enter the initial amount ($5), the starting year (1960), and the target year (2024).

Get your results: The calculator will quickly compute the equivalent value of $5 in 1960, adjusted for inflation, in 2024 dollars.

Using this method, we find that $5 in 1960 is approximately equivalent to $53.66 in 2024.

What Could $5 Buy in 1960?

In 1960, $5 could purchase a substantial amount of goods and services. Consider these examples:

- Gasoline: A full tank of gas for a car was frequently achievable.

- Family Dinner: A satisfying family meal at a local restaurant was certainly possible.

- Entertainment: A family could attend a movie or two.

- Groceries: A significant portion of a family’s grocery needs could be met.

This highlights the stark contrast between purchasing power then and now.

The Impact on Different Stakeholders

This dramatic change in value highlights the crucial role of inflation in financial planning. The implications are far-reaching, impacting various stakeholders:

Individuals: Understanding inflation is vital for effective budgeting, saving, and retirement planning. Failing to account for inflation can severely impact long-term financial goals.

Businesses: Businesses must consider inflation when setting prices, managing costs, and forecasting revenue. Ignoring inflation can lead to decreased profitability and poor financial performance.

Governments: Government agencies use inflation data to adjust social security payments and other benefits to maintain purchasing power. Budgetary planning also requires incorporating inflation projections.

Key Takeaways: A Financial Reality Check

- The purchasing power of $5 in 1960 was significantly higher than today.

- Inflation consistently diminishes the value of money over time.

- Utilizing online inflation calculators simplifies the comparison of money across different years.

- Understanding inflation is paramount for sound financial decision-making.

Further Exploration: Diving Deeper into Inflation

This exploration serves as an introduction to the broader topic of inflation. Further research into historical inflation rates, the impact of specific economic events on inflation, and different asset classes' reactions to inflation can provide a more comprehensive financial literacy. Explore resources like the BLS website 1 to delve deeper into the complexities of this critical economic indicator.